Tesla made $2.9 billion, excluding exceptional items, a 22% decrease from the prior year despite lowering the cost of its electric vehicles a total of four times in the last quarter and twice so far this month. Compared to both the third and fourth quarters of the previous year, profits decreased considerably more.

Despite record deliveries, lower costs caused revenue to drop by $1.3 billion from the previous quarter, which resulted in narrower profit margins.

The margin of gross profit for Tesla was 19.3%. Even though it is far higher than the profit margin of conventional automakers, it is lower below Wall Street expectations and is down approximately ten percent from the level it reported a year earlier.

22 September, Santa Monica, California On September 22, 2022, a Tesla Model 3 car is on show at the Tesla dealership in Santa Monica, California. Because the windows might prick a person’s fingers when rolled up, Tesla plans to recall more than one million vehicles in the U.S. These electric vehicle models qualify for new tax credits of up to $7,500.

Despite having a small portion of the sales of well-established international automakers, the firm is by far the most valuable carmaker in terms of market capitalization. The company’s high values are mostly attributable to its profit margins and ambitious expansion objectives.

Established manufacturers are posing a rising threat to Tesla in the EV market. Some companies, including Ford (F), followed suit and reduced the price of the Mustang Mach-E, one of its most important EVs. Others have made plans for EV versions that will be less expensive than the most affordable Tesla model, including General Motors.

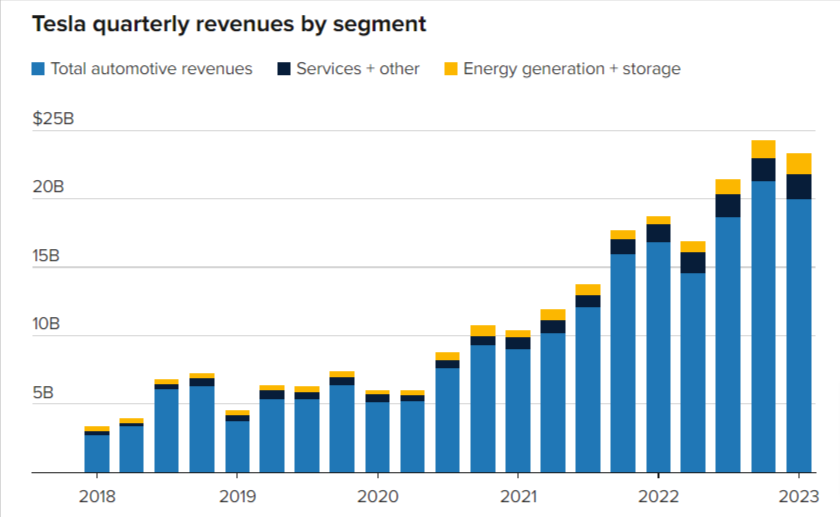

Revenue for Tesla Energy skyrocketed to $1.53 billion, a 148% increase over the same time in 2017. According to the firm, the deployment of Tesla’s energy storage devices climbed by 360% to 3.9 GWh. The Powerwall home backup batteries and the utility-scale Megapack system, both manufactured by Tesla, are examples of lithium-ion batteries-based energy storage systems. These systems allow utilities to store and utilise more energy produced by intermittent renewable sources like solar and wind.

Source: Company reports

Data for Q1 2023 published April 19, 2023

In a first for the EV manufacturer, Tesla’s first-quarter results teleconference will be live-streamed through Twitter. In order to finance a $44 billion acquisition of the social networking firm, where he is currently also CEO, CEO Elon Musk sold billions of US dollars worth of his stakes in Tesla.

Along with further price reductions Tuesday night, the corporation made price cuts to its automobiles at the end of the previous year and into the first quarter of 2023. Tesla is simultaneously developing ambitious strategies for growth and more capital expenditures.

Tesla presently offers four electric vehicles (EV) models, which are built in two American auto assembly factories, one in Shanghai and one outside of Berlin.

In January, Tesla’s finance head Zachary Kirkhorn made a commitment that the company will maintain margins of 20% and a median selling price of $47,000 for all models.

On Wednesday, Tesla reaffirmed that it anticipates making about 1.8 million vehicle deliveries this year.

The EV manufacturer has already admitted that it delivers much fewer vehicles than it produces due to logistical problems. It delivered around 18,000 fewer automobiles than it produced in the first quarter.

According to 22 analysts surveyed by Refinitiv, the business posted first-quarter sales of $23.33 billion, above the $23.21 billion consensus forecast.

The business posted a $2.5 billion net profit, down from $3.32 billion in the prior year.

Check Previous Article: What is Baby Doge Coin

Breaking News Live 24

Breaking News Live 24